How to make a difference in farming without owning a farm

Around 12,000 years ago, our hunter and gatherer ancestors first began to farm. They herded wild animals such as goats and wild oxen and grew a variety of crops like peas, lentils and barley. Around 5500 BC, the Sumerian civilization of the Middle East and other early pre-Greco-Roman civilizations began to understand the need for specialized agricultural technology such as the invention of irrigation which allowed for the first cities to emerge. Some of the most complex societies of the ancient world were mostly successful due to their agricultural systems.

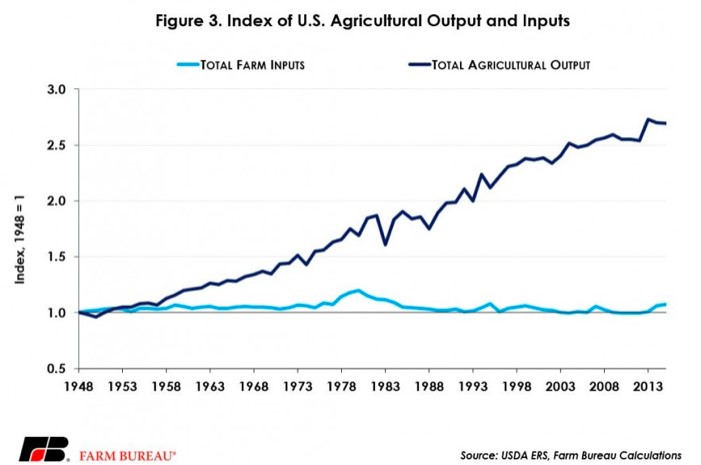

In the last century traditional farming has changed in very significant ways. Over a short period of time, innovations in farms’ production practices, risk management and business arrangements have allowed farmers to greatly increase their output without raising total input use.

These changes led to a shift from small family owned farms to large corporation owned farms. With this shift many people’s connection to how our food is actually grown and where it comes from got lost. International food giants dominate virtually every step in the cycle of global food production. According to studies by the UN and other organizations agriculture contributes around 15 to 20 percent of the world’s greenhouse gas emissions. Many people underestimate agriculture’s contribution to the climate crisis and its harmful long-term effects.

It is time for us to find a way to reconnect and raise awareness for our food system and support sustainable agriculture practices that are sufficient enough to meet the demand of our growing population. Impact investing provides an enormous potential to fix our broken food system and is paving the way toward sustainable farming practices.

According to the Global Impact Investing Network, 63 percent of impact investors said they were investing in food and agriculture, and impact investment in the sector has grown at an annual rate of 32.5% since 2013

In 2017 the Croatan institute published a comprehensive report on impact investing in sustainable food and agriculture across the different asset classes. The report gives comprehensive examples on how “conventional asset classes such as cash, fixed income and public equity” and “alternatives such as private equity, venture capital and real assets” are important to make a positive impact in agriculture.

One common approach for foundations is setting up program-related investments (PRIs), which allow private foundations to invest in mission aligned projects that generate returns

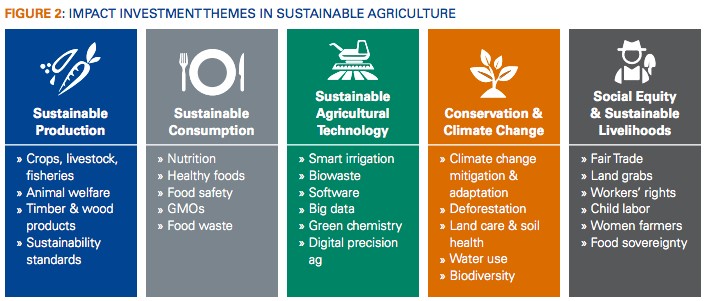

Essentially there are five different investment themes in sustainable agriculture:

There are many different investment opportunities in agriculture but one of the most promising seems to be sustainable agricultural technology.

The use of sensor and artificial intelligence can help produce plants with more nutritious yields and reduce unusable plant biomass. In her article, Dahl Winters describes how sustainable agriculture can be achieved with the latest technologies such as artificial intelligence, sensors, imagery and integrated systems.

Transformation is specialized in impact investments in the markets of energy, water, agriculture and healthcare. By integrating the latest technologies with sustainable innovations, clients achieve lasting profit, while maximizing system efficiency and impact.

Leave a Reply