What you need to know about impact investing.

Impact investments are investments that have direct positive social and/or environmental impact with measurable financial returns. Impact investments are meant to make money, while promoting and maintaining social and/or environmental responsibility.

In 2019, the Global Impact Investing Network published its 4 characteristics of impact investing:

- Intentionality

- Impact investing is marked by an intentional desire to contribute to measurable social or environmental benefit. Impact investors aim to solve problems and address opportunities. This is at the heart of what differentiates impact investing from other investment approaches which may incorporate impact considerations.

- Impact investing is marked by an intentional desire to contribute to measurable social or environmental benefit. Impact investors aim to solve problems and address opportunities. This is at the heart of what differentiates impact investing from other investment approaches which may incorporate impact considerations.

- Use Evidence and Data in Investment Design

- Investments cannot be designed on hunches, and impact investing needs to use evidence and data where available to drive intelligent investment design that will be useful in contributing to social and environmental benefits.

- Investments cannot be designed on hunches, and impact investing needs to use evidence and data where available to drive intelligent investment design that will be useful in contributing to social and environmental benefits.

- Measure Impact Performance

- Impact investing comes with a specific intention and necessitates that investments be managed towards that intention. This includes having feedback loops in place and communicating performance information to support others in the investment chain to manage towards impact.

- Impact investing comes with a specific intention and necessitates that investments be managed towards that intention. This includes having feedback loops in place and communicating performance information to support others in the investment chain to manage towards impact.

- Contribute to the Growth of the Industry

- Investors with credible impact investing practices use shared industry terms, conventions, and indicators for describing their impact strategies, goals, and performance. They also share learnings where possible to enable others to learn from their experience as to what actually contributes to social and environmental benefit.

What’s the difference between ESG, SRI and Impact Investing?

Impact investing is not the same as ESG. ESG stands for Environmental, Social, Governance and are simply factors in assessing impact of a company or investment. While ESG provided the basic framework that would support the foundation of impact investing, the focus is on the operations of the business rather than the fundamental business itself. ESG is used for assessment and scoring purposes only and doesn’t necessarily impact investment decisions.

Social Responsible Investing, or SRI, takes ESG one step further. It’s an investment strategy that makes investment decisions based on social, environmental and/or ethical factors (may or may not consider ESG specific factors). SRI investor’s intent is to maximize returns, but do so in a way that minimizes negative societal impact. Therefore, SRI investors may choose not to make an investment if the investment does not meet specified criteria or violates one’s conscience.

Impact Investing takes SRI another step further. Social and environmental responsibility is the foundation of impact investing rather than a consideration. It is the purpose of the investment itself. Impact investments require financial returns, but have a wide range of financial returns depending on the type of investor. Impact Investing also requires transparency and accountability.

Who is making impact investments?

- Fund Managers

- Development finance institutions

- Diversified financial institutions/banks

- Private foundations

- Pension funds and insurance companies

- Family Offices

- Individual investors

- NGOs

Religious institutions

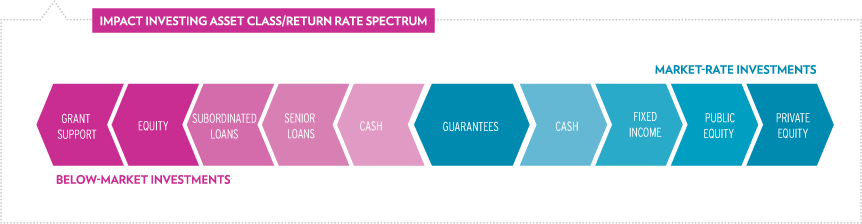

Target financial returns will vary depending on the type of investor and asset class. The below chart maps out the range of returns by asset class:

As of April 2019, GIIN estimated that the impact investment market was $502 billion. We expect this number to grow as consequences of climate change and pollution become global catastrophes. The impact investment market is an opportunity for investors to drive real positive change while generating high market returns. This is not only necessary, but essential to the preservation of the world and also business.

What Transformation says about impact investment:

Transformation focuses on the investment of energy, water, agriculture and healthcare. Investment in these markets must be directly focused on improving total system efficiency. In addition, Impact Investing includes investment into the sustainability nexus where one or more of these areas converge and benefit human and animal health.

Transformation aims for market rate investments and expects comparable market returns. In order for any project or investment to be sustainable, it must first be profitable. We must work across the entire spectrum of energy, water and agriculture, and our research and analysis must be based on science and total system efficiency.

Therefore, we redefine Impact Investing as:

Where Sustainability Meets Profitability –

for the Future and the Present. “

Leave a Reply