The Difference Between Sustainable Investing and Impact Investing

There is an increasing awareness for environmental issues and the impacts of climate change. With that awareness, many investors are interested in seeking out investments that do some good to the world while providing profitable returns. This article seeks to provide some clarity between the differences in sustainable investing vs impact investing, two similar, yet very different, ecologically-friendly investing paths.

Sustainable Investing vs Impact Investing

Sustainable investing (also known as ESG investing) and impact investing are often confused, and rightly so. However, they are pretty different from an investment approach.

Sustainable investments look mainly at the company operations and determine whether they have “positive” Environmental, Social, and Governance (i.e. ESG) metrics or, at the least, no “negative” metrics.

On the other hand, impact investing pays more attention to the actual products and services a company is offering that have a more direct impact in the areas of sustainability and social welfare. An impact investing company still has to have sound environmental, social and governance practices in its operations. However, its focus is mainly on selling solutions, products, and services that help the world achieve its sustainability goals.

In general, sustainable investing allows investors to ensure they are not investing in companies with a net negative impact, whereas impact investing ensures there is a net positive impact.

Types of Impact Investments:

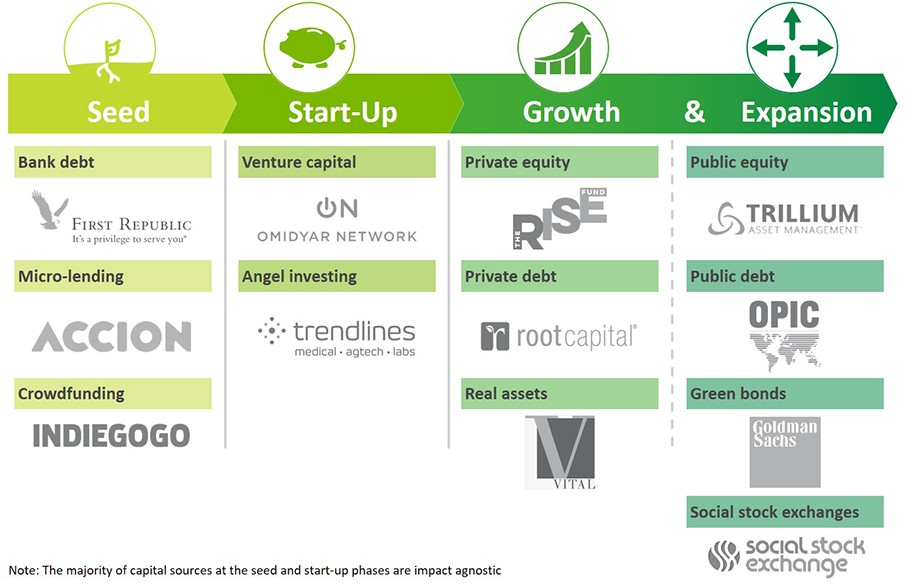

Since there is a wide range of areas that investors are interested in seeing positive impact, as well as performance expectations, there is by nature, various realms of impact investing. Common types of impact investments include:

- Green Bonds

- Socially Responsible ETF’s

- Private sector impact investments

However, as you can see here, impact investing is not limited to a size or type of investment vehicle. Since there is no regulation on the definition of impact investing, all of the areas below can act as potential “impact investments”.

Types of Sustainable Investments:

Environmental, social and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. ESG-minded business practices have gained more traction and investment firms are increasingly tracking their performance, providing different options for investors.

Equities

Green stocks are becoming more competitive due to the growth of climate awareness, advancing technologies, and low cost of cleantech

Bonds

Projects that are funded by green bonds are focused on energy efficiency, pollution reduction, transportation and innovative green technologies.

Exchange-traded funds

ETF are investment funds that are being traded on stock exchanges, much in the same way as stocks

Hedge Funds

Hedge Fund managers are prioritizing ESG to keep up with investor demands, ensuring to follow ESG criteria that is centered in corporate values and sustainable production

The demand for impact investing is higher than ever today and continues to grow. At Transformation, we are taking the opportunity of this demand to create sustainable and high-impact projects in the areas of energy, water, agriculture, and technology.

Leave a Reply