It’s an understatement to say that impact investing is growing quickly. In fact, there’s never been a better time to invest in sustainable resources. Driven by a changing societal awareness of ecological issues, businesses and investors alike are looking for sustainable investments, innovations and initiatives. One area that is often looked at is renewable energy investing.

The demand for global energy is on a steep upward trajectory, with a 50% projected worldwide growth in the energy industry by 2050. Of course, some of that growth will go towards the traditional fossil fuels of cheap coal and natural gas. However, change is on the horizon. A new report by Bloomberg New Energy Finance projects a rising market share for renewable energy, accounting for over 75% of power investment cost.

Renewable Energy: Investing, Sources and Examples

For the investor with a new green energy portfolio in hand, ready to build it up, the numbers sound exciting. This is especially true in 2021, where you can also add the potential for supportive federal actions. But what is renewable energy? What sources fall under renewable energy?

What about cost? Are alternative energy options cheaper? Can it replace fossil fuels?

What are some examples and - most importantly - how can you invest in renewable energy? Read on for the answer to those questions.

What is Renewable Energy, and Where Does It Come From?

Renewable energy, sustainable energy, clean energy - it all means the same thing. To fall under this classification, energy has to come from natural resources or processes that are constantly renewed, such as sun, water, and wind. All of these resources can be harnessed - and have been in past times - to create energy.

Although the ways we use energy have grown, the idea of renewable energy isn’t a new one. Humanity has used wind energy to run windmills for grain and sails to power boats. We’ve told time by the sun, and warmed ourselves in solar energy.

Through impact investing, renewable energy innovations help to develop better ways to use sun, wind and water for transportation, lighting, heating, and more.

Nonrenewable Energy

Contrast this to “dirty energy”, or nonrenewable energy. They come from natural resources, but those resources are finite and take a long time to rebuild: crude oil, gas, coal. As well, they’re only found in specific areas around the world, which gives resource-rich countries leverage on the world scene.

Finally, the methods of mining and processing these nonrenewable energy resources contribute to environmental pollution and global warming. They have served their place in the grand scheme of things. However, there is now enough growth in the renewable energy sector to move forward and take the lead.

Can Renewable Energy Replace Fossil Fuels?

This is already in process. According to the U.S. Energy Information Administration, nearly 14,000 MW of coal-fired capacity was retired in 2019. This drop in coal was replaced by nearly 23,000 megawatts (MW) of wind power, natural gas and solar power. Long term, alternative energy is on the rise no matter where you are in the United States.

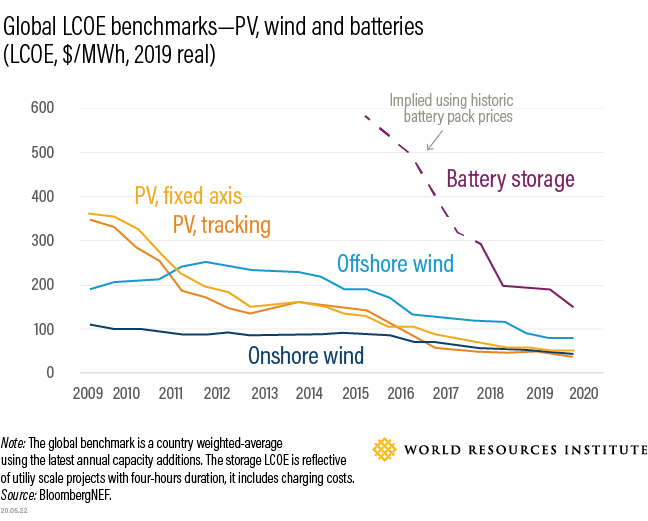

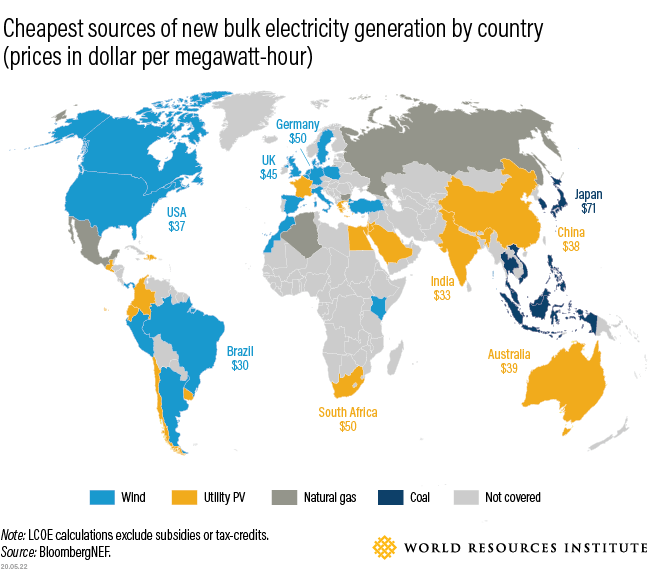

Cost has always been a consideration, but renewable energy investments have helped power innovations that reduce production costs by significant amounts. Over the past decade, onshore wind has dropped $66/MWh, and utility-scale solar has dropped a whopping $250/MWh per hour. In fact, renewable energy storage, which is a critical component of alternative energy usage, has dropped by $450/MWh since 2015. This makes onshore wind power and utility-scale solar power the cheapest sources of electricity generation in two-thirds of the world.

Examples of Renewable Energy

We have talked a lot about wind and sun, but are those the only types of renewable energy available? Can you only invest in better solar panels, or wind farms? There are several types of alternative energy, all of which can become part of your investment portfolio.

Solar Energy

Solar energy, produced by the sun, is converted into electricity via solar panels, which then store the harvested power in solar cells. Because of the ability to store that power, there is a virtually endless supply of solar energy, reducing the cost of energy overall.

Investing in solar energy can help with innovations to make the prohibitive upfront cost more realistic. As well, for some businesses and personal homes, it can be hard to place solar collectors where there is enough space and sunlight. Because of these issues, switching electrical grids to pure renewable energy is still a work in progress.

Wind Energy

Wind systems convert wind into electricity with the use of wind turbines. They come in several forms ranging from utility-scale to commercial grade to single-wind units.

A source of clean energy, wind energy doesn't produce harmful biproducts. As well, it provides the opportunity for new jobs and job training for servicing and maintaining the turbines.

Investing in wind energy innovations can help find more efficient ways of harnessing the power of the wind. Cities generally don't have the space to host wind farms, so transition lines need to be laid from the farm to the electrical grids.

Water Energy

Water energy, or hydroelectric energy, is created through the use of dams. Water produces pumped-storage hydropower through the dam's turbines. Hydroelectric facilities are very scalable, ranging from large projects such as the Hoover Dam to smaller projects such as small rivers.

While solar and wind energy markets are saturated with innovation and development, the area of water energy is ripe with opportunity for creating solutions. Inefficiency and the negative affect on the animals that live in the water ways are needed targets for renewable energy investing.

Much like wind energy, investing in water energy innovations can target more efficient ways of harnessing wind. In general, a hydroelectric facility uses more energy than it produces, which means it is currently an ineffectual choice for long-term energy production. As well, it disrupts waterways and ecosystems. Developing methods of processing hydroelectric energy that address these two issues would make great strides towards further removal of fossil fuels.

Other Renewable Energy Sources

There are several more sources that either aren't as well known, are more costly, or are more virgin fields of investment (and thus development).

Geothermal energy has significant potential, is naturally replenished, and has a small footprint. However, the cost of infrastructure and vulnerability to earthquakes makes it less viable than solar, wind or water energy.

Ocean energy produces thermal energy and mechanical energy. Ocean mechanical energy is produces through the ebbs and flows of tides (tidal energy), and the movement of waves (wave energy). These are virtually untapped energy resources with massive potential, but currently also have several limitations.

Bioenergy is created by organic matter (biomass), either by burning or decomposition (methane gas). Biomass can be something as simple as a piece of burning wood, or as complicated as the methane that comes from decomposing landfills. Like geothermal and ocean energy, investing in bioenergy innovations is an area ripe with opportunity.

Renewable Energy Investing

It’s clear that investing in renewable energy is one way to grow a healthy “green” investment portfolio. How do you get started with so many options and opportunities? Here are a few places you can start looking:

Select Energy Companies

As mentioned at the beginning, fossil fuel plants are being replaced with renewable energy infrastructures. Impact investing with an eye towards target energy stocks that are actively embracing renewable energy options is a good start.

Solar Panel Production

Along with the increase of infrastructure comes solar panels. As solar power becomes even more prevalent and adoption grows, so will the companies producing solar panels. JinkoSolar Holding (JKS) is an excellent example of target companies to invest in.

Renewable Energy Stocks

Renewable energy stocks are a strong option. At this time, Brookfield Renewable (BEP/BEPC) is a top stock. The company has the lofty goal of investing up to $1 billion per year through 2025, focusing on new solar energy developments. A strong performer, it’s set to be a good investment for years to come.

Impact Investment Project Development

Although there are several options, project development is our bailiwick. We help SWFs, family funds, private equity and global company investors find the sustainable projects that align with your portfolio and moral goals. Whether your target is ESG investing with an eye toward what means most to you, or impact investing with a goal towards a green portfolio, we can help.

View some of our example projects, or contact us to discuss your impact investment goals.

You don't have to decide between making a positive impact or making a profit. Join Transformation Holdings and our network of organizations in the move towards changing lives.